INTRODUCTION:

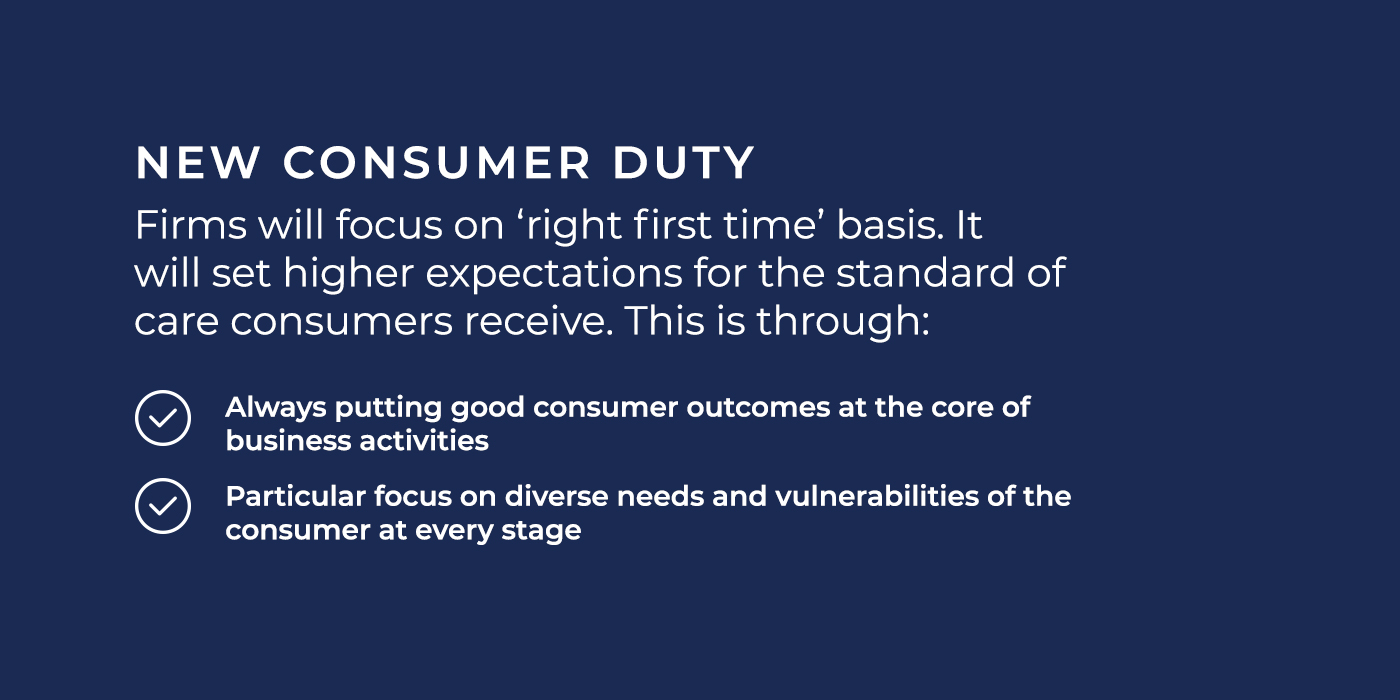

In a constant effort to protect and empower consumers in the financial sector, the Financial Conduct Authority (FCA) has introduced its latest policy initiative—the Consumer Duty. With a core objective to ensure fair treatment of customers, this new policy is set to revolutionise the relationship between financial firms and their customers. With the new rules coming into force on 31st July, in this blog post, we will delve into the details of the Consumer Duty policy, exploring its significance, key components, and potential impact on consumers in the UK.

ENHANCING CONSUMER PROTECTION:

The FCA has always placed consumer protection at the heart of its regulatory framework. The Consumer Duty policy serves as an extension of this commitment, aiming to enhance the existing conduct rules for financial firms and promote better outcomes for customers. It seeks to establish a higher standard of care and responsibility in the industry, ultimately empowering consumers and fostering trust in financial products and services.

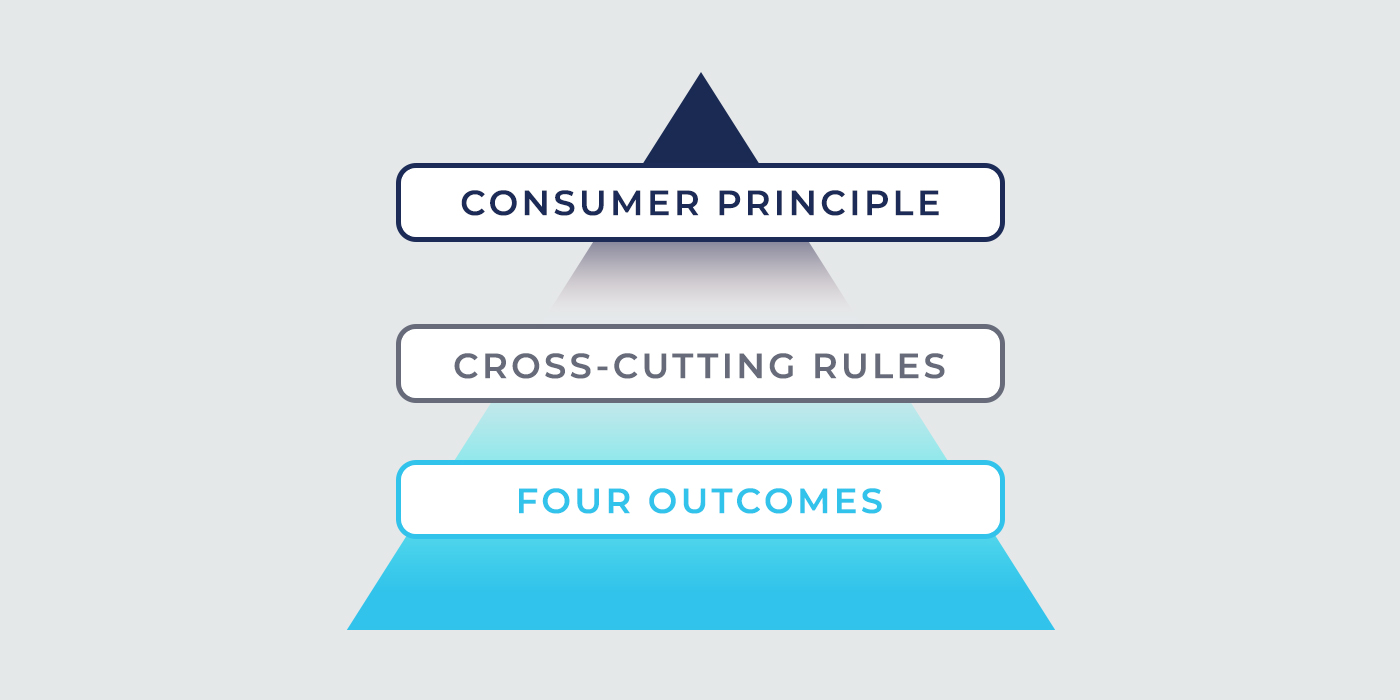

KEY COMPONENTS OF THE CONSUMER DUTY POLICY:

- Duty of Care: The FCA has introduced a formal duty of care for all financial firms. This duty requires firms to act in the best interests of their customers, to exercise due skill, care, and diligence, and to take reasonable steps in order to avoid any potential harm to consumers.

- Product and Service Quality: Financial firms are obligated to ensure that the products and services they offer are suitable for customers’ needs and to deliver expected outcomes. Firms need to focus on maintaining high standards of quality and providing clear and transparent information to help consumers make informed decisions.

- Fair and Accessible Pricing: The Consumer Duty policy emphasizes the importance of fair pricing for financial products and services. Firms are required to ensure that pricing is transparent, competitive, and easily understandable. This component aims to tackle issues such as hidden fees and unfair practices, ultimately promoting a more equitable marketplace.

- Communications and Disclosure: Recognising the significance of clear and understandable communication, the FCA has established guidelines which ensure firms communicate with consumers in a way that is clear, fair, and not misleading. This component seeks to address the issue of complex jargon and convoluted terms and conditions, allowing consumers to make informed decisions without confusion or undue pressure.

IMPACT ON CONSUMERS:

The implementation of the Consumer Duty policy holds significant implications for consumers across the UK. With the introduction of a formal duty of care, consumers can expect financial firms to prioritise their best interests and work towards building long-term relationships based on trust. The emphasis on product and service quality, fair pricing, and clear communication will empower consumers to make well-informed financial decisions, fostering a more competitive and customer-centric marketplace.

Moreover, the Consumer Duty policy encourages consumers to actively engage with financial firms, voice their concerns, and hold them accountable for their actions. The FCA aims to make it easier for consumers to seek appropriate redress and ensure they have access to effective dispute resolution mechanisms when necessary.

CONCLUSION:

The FCA’s Consumer Duty policy is a bold step towards enhancing consumer protection and promoting fair treatment within the financial industry. By imposing a formal duty of care and focusing on product quality, fair pricing, and transparent communication, the policy strives to empower consumers and strengthen their confidence in financial firms. As the UK continues to foster a consumer-centric financial landscape, this policy is a significant milestone in

safeguarding the interests of individuals and promoting a culture of trust and accountability within the industry.

With the new rules coming into force on 31st July firms should be on track to meet the regulators expectations. If you would like to learn more or see how we can help support you with your ongoing compliance needs then simply complete our contact form and we’l lget back to you without delay.