In an era of increasing awareness surrounding financial fairness and ethical business practices, the protection and well-being of Vulnerable Customers have come into sharp focus. The Financial Conduct Authority (FCA) has taken notable steps to emphasise the significance of recognising and understanding the needs of these customers, ensuring that they receive suitable products and services. But why is this so crucial?

Defining Vulnerable Customers

The FCA defines vulnerable customers as

“Vulnerable customers are someone who, due to their personal circumstances, is especially susceptible to harm – particularly when a firm is not acting with appropriate levels of care.”

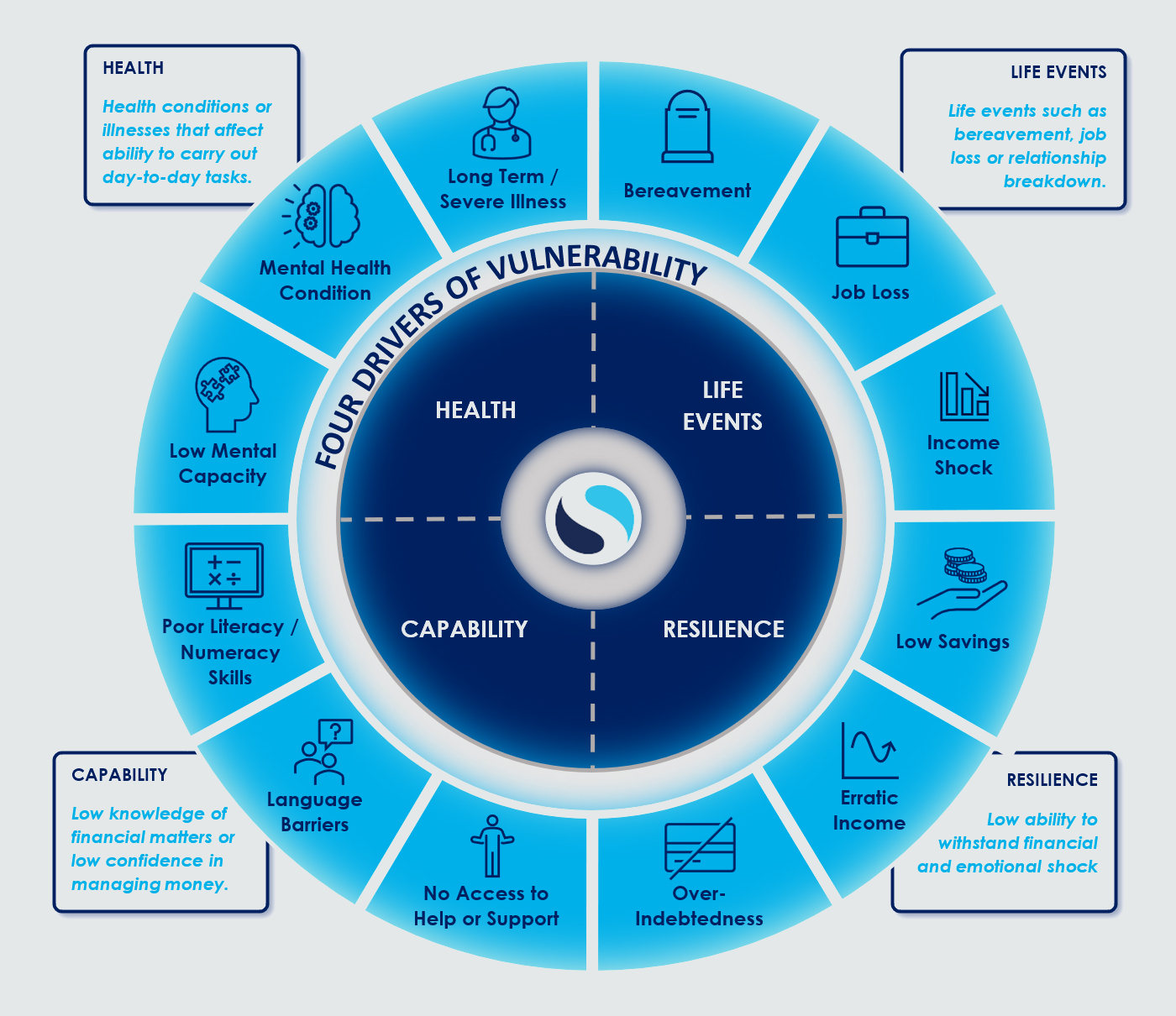

These personal circumstances could range from health issues to financial instability, age-related factors, or even language barriers. In essence, vulnerability encompasses a wide spectrum of challenges that can significantly impact an individual’s financial well-being.

The FCA’s Commitment

The FCA has built upon existing guidance surrounding the fair treatment of vulnerable customers. The FCA recognises that firms have a responsibility to treat all customers fairly, irrespective of their vulnerability status.

Implementing Clear Controls

One of the core aspects of the FCA’s approach is the requirement for firms to implement clear controls for recognising and documenting when a customer is ‘vulnerable.’ This involves a proactive approach to identifying signs of vulnerability and documenting them appropriately. By doing so, firms can tailor their interactions and product offerings to meet the unique needs of each customer, ensuring they are not put at undue risk.

The New Consumer Duty

The introduction of the Consumer Duty adds an additional layer of responsibility on firms. This duty compels firms to go beyond identifying vulnerability; it mandates a deeper understanding that all customers, regardless of their initial circumstances, are at risk of becoming vulnerable. This is a fundamental shift in perspective, one that emphasises the need for clear, fair, and not misleading information, with a continuous duty of care.

Why It Matters

Understanding and meeting the needs of vulnerable customers is not just a matter of compliance; it’s a matter of ethics and good business practice. Here’s why it matters:

Financial Inclusion: By catering to the needs of vulnerable customers, firms contribute to a more inclusive financial ecosystem where everyone has the same level of access to suitable products and services.

Avoid foreseeable harm: Identifying and addressing vulnerabilities early can prevent customers from falling into financial hardship or making detrimental financial decisions.

Enhanced Reputation: Firms that prioritise the well-being of their customers build trust and a positive reputation, leading to long-term customer loyalty.

Consumer Duty: Adhering to FCA guidelines and the Consumer Duty is not just a legal obligation but also a marker of responsible business conduct.

Recognising and understanding the needs of vulnerable customers is not only a regulatory requirement but a moral imperative. It’s a commitment to ensuring that all individuals, regardless of their circumstances, have the opportunity to thrive financially.

Further Considerations

- Firms should understand that characteristics of vulnerability are likely to be complex and overlapping.

- Firms should understand what characteristics of vulnerability are likely or more often to be present within their target market or customer base.

- Consumers may not want the label ‘Vulnerable’ applied to them. It is suggested not to directly use the term during interactions, instead the focus should be on what the potential harm/disadvantage may be.

- Not all customers with characteristics of vulnerability will be vulnerable, but they may be more likely to have additional or different needs which may impact ability to make decisions, or to represent their own interests.